Smart EV Charging Stations

Charging solutions for all businesses & EV drivers.

We’ve been helping councils, fleet managers, vehicle manufacturers, charge point

operators and commercial businesses in their decarbonisation and EV transition

with infrastructure solutions that solve the key problems and future proof thier sites.

operators and commercial businesses in their decarbonisation and EV transition

with infrastructure solutions that solve the key problems and future proof thier sites.

- Problem

- Solution

- Benefits

Problem

- Incoming Capacity Issues

- Increased DNO cost and time scales

- Infrastructure Costs

Solution

- No DNO increase needed

- Any Capacity Issues Can Be Absorbed

- Scalable Solution Growing With Your Demand

Benefits

- Lower Infrastructure Costs Over Time

- Lower Cost Of Vehicle Charging

- Increased Energy Efficiency Usage

# 1

top leader in EV technology

and solutions

and solutions

5000 kW+

of deliverable energy from a single site

for commercial vehicles to charge

for commercial vehicles to charge

10 +

years of experience in

EV infrastructure and technolgy

EV infrastructure and technolgy

99.9 %

of charging capacity

demand availible 100% of the time

demand availible 100% of the time

Why GridToday

An award-winning EV infrastructure designed from the ground up with the focus on the future.

The transition to electric vehicles is accelerating year after year — and it's clear the world is going electric. GridToday was born from over a decade of hands-on experience in the EV industry. During this time, we identified recurring challenges in EV charging: evolving technologies, inconsistent infrastructure, and a general lack of future-ready solutions. As the industry matured, it became evident that the sector was grappling with a steep learning curve.

From this understanding, GridToday set out with a bold mission: to design an intelligent, scalable infrastructure solution that not only solves the most common EV charging problems but redefines how we think about powering electric mobility. We took a holistic view, evaluating how the past decade of infrastructure decisions would hold up against future demands. Beyond just vehicles and chargers, we looked deeper — at the growing pressure on national power grids, at inefficiencies in energy use, and at the complexity of distribution networks. Our insight? The future isn’t just electric — it’s connected, intelligent, and DC-powered.

GridToday’s platform was developed with two transformative ideas in mind:

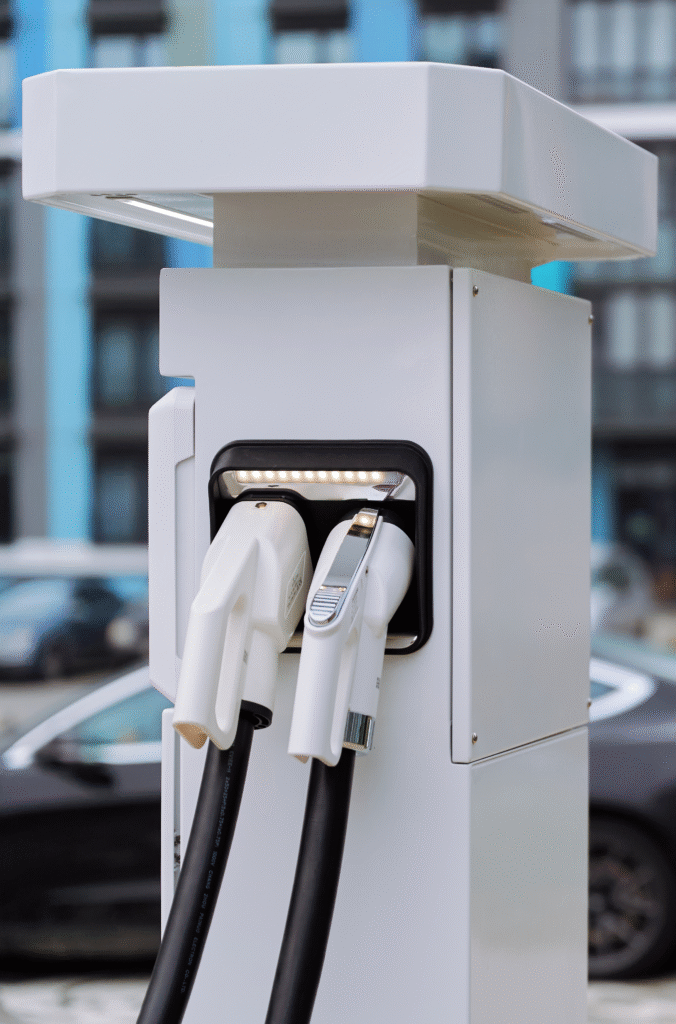

1. DC-first architecture — to meet the high energy demands of commercial fleets efficiently.

2. Connected Energy ecosystems — integrating battery storage, renewables, smart management systems, and scalable hardware.

We knew that commercial EV users couldn’t rely on traditional infrastructure: costly and time-consuming DNO connections, rigid grid dependency, and outdated charging models were holding fleets back. So we built a system that adapts. A system that is flexible, modular, and significantly reduces both capital and operational expenditure.

Our Vision

GridToday empowers fleet operators and businesses with a solution that:

Cuts EV charging energy costs by over 20%

Minimizes reliance on the national grid

Avoids unnecessary DNO delays and costs

Scales seamlessly with your operations

Integrates with on-site renewables and battery storage

This is more than infrastructure — it’s a movement toward energy independence and intelligent charging. As we expand, GridToday will continue to pioneer solutions that accelerate the EV revolution, reduce environmental impact, and give commercial users full control of their energy future.

The journey has only just begun.

From this understanding, GridToday set out with a bold mission: to design an intelligent, scalable infrastructure solution that not only solves the most common EV charging problems but redefines how we think about powering electric mobility. We took a holistic view, evaluating how the past decade of infrastructure decisions would hold up against future demands. Beyond just vehicles and chargers, we looked deeper — at the growing pressure on national power grids, at inefficiencies in energy use, and at the complexity of distribution networks. Our insight? The future isn’t just electric — it’s connected, intelligent, and DC-powered.

GridToday’s platform was developed with two transformative ideas in mind:

1. DC-first architecture — to meet the high energy demands of commercial fleets efficiently.

2. Connected Energy ecosystems — integrating battery storage, renewables, smart management systems, and scalable hardware.

We knew that commercial EV users couldn’t rely on traditional infrastructure: costly and time-consuming DNO connections, rigid grid dependency, and outdated charging models were holding fleets back. So we built a system that adapts. A system that is flexible, modular, and significantly reduces both capital and operational expenditure.

Our Vision

GridToday empowers fleet operators and businesses with a solution that:

Cuts EV charging energy costs by over 20%

Minimizes reliance on the national grid

Avoids unnecessary DNO delays and costs

Scales seamlessly with your operations

Integrates with on-site renewables and battery storage

This is more than infrastructure — it’s a movement toward energy independence and intelligent charging. As we expand, GridToday will continue to pioneer solutions that accelerate the EV revolution, reduce environmental impact, and give commercial users full control of their energy future.

The journey has only just begun.

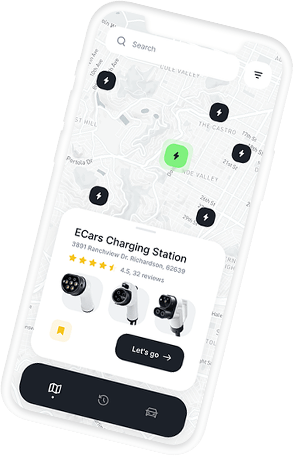

Fully Supported Back Office Designed For Your Needs

Our back office solution is designed to be unique to every customer, with everything from branding to reporting and energy analasis. This allows us to integrate every element you need to make your transition meet the very best standard. User management with monetisation built in ensuring all your BiK and HR departments can be integrated from the start.